Capital Stacking & Engeneering

Capital stacking is not an art of layers — it’s the science of leverage.

Capital Stacking & Engeneering

Capital stacking is not an art of layers — it’s the science of leverage.

Our Approach

We treat fund financing & stacking as an engineered system that make capital move intelligently. Every structure, lender relationship, and liquidity mechanism is designed with precision to increase velocity, reduce friction, preserve control, and credibility.

We operate where capital meets intelligence.

We combine

Balancing credit/debt, equity, and/or guarantees into one cohesive structure.

Mapping capital needs to deployment tempo.

Aligning lender perception, risk appetite, and fund narrative.

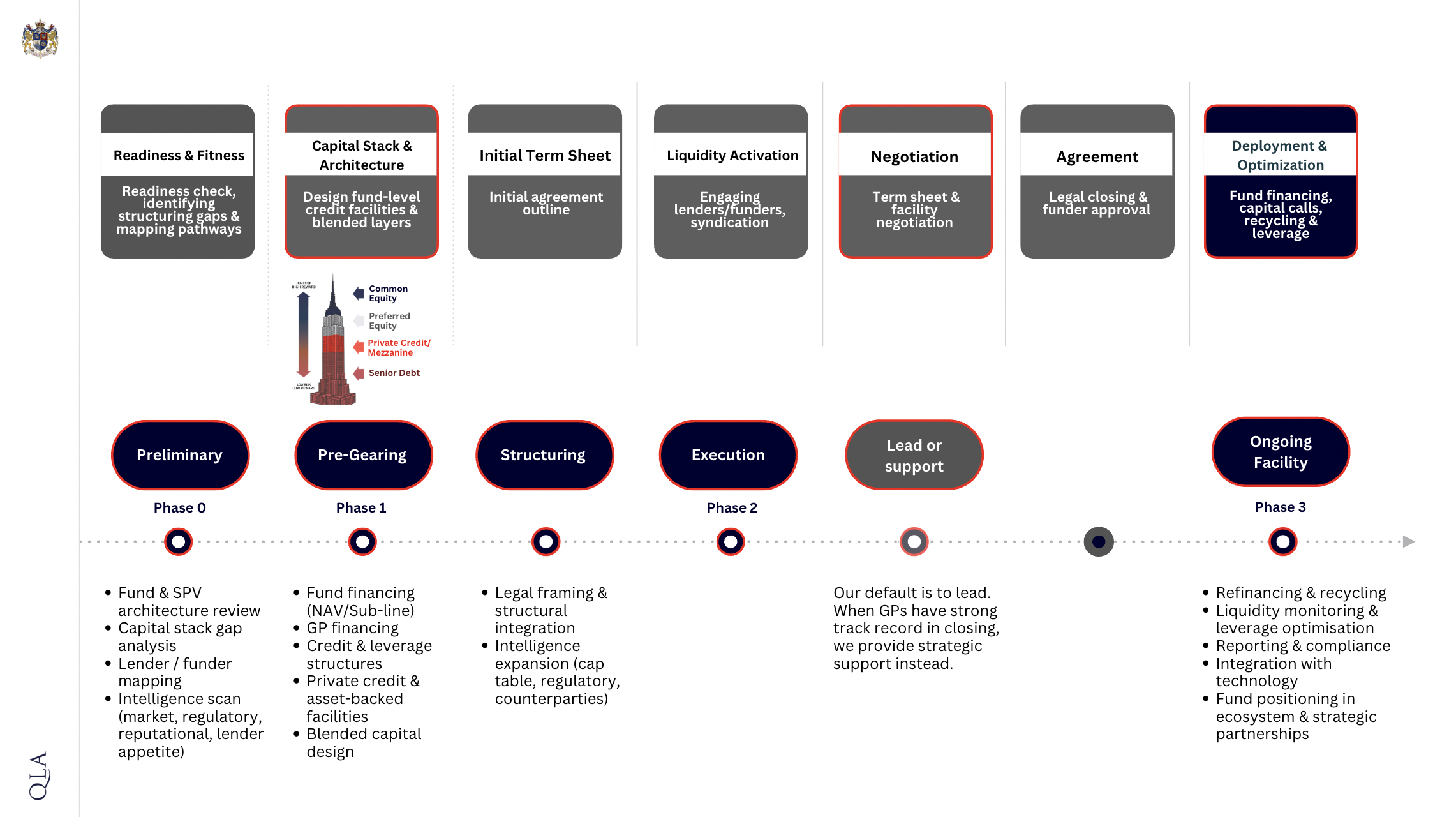

Our Methodology

Benefits & Impact

I) Liquidity velocity: Accelerate deployment across sectors without waiting for LP drawdowns.

II) Cost optimization: Blend capital sources to lower weighted cost of funds.

III) Institutional credibility: Strengthen fund reputation with global lenders and co-investors.

IV) Risk containment: Diversify financing exposure through structured instruments.

V) Scalability: Create repeatable financing systems for future funds and projects.

Our Added Value: 360° Capital Intelligence

- Integrated view of fund, project, and collateralized liquidity.

- Real-time alignment between financing, deployment, and reporting.

- Data-driven enhanced financial storytelling for institutional confidence.

- Global lender network activation, negotiation, post-close monitoring.

Outcome: the fund gains a capital engine — capable of recycling, multiplying, and redeploying liquidity across multiple sectors.

Request an Intro through a trusted channel.

Investing involves risk, including the potential loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, projected returns, or probability forecasts may not reflect actual future performance. Although the data we use from third parties is considered reliable, we cannot guarantee its accuracy or completeness.

Neither Christopher Voolaid, QLA nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax, legal and/or financial adviser before making any investment decision.

Christopher Voolaid and at QLA, we believe success relies on work ethic, knowledge, and consistency. By using the information on this website, you agree to assume full responsibility for your results.

For additional important risks, disclosures, and information, please visit https://qla.ee/disclosures

Talk to Us

IR (Investor Relations): investors@qla.ee

General Info: info@qla.ee

Fax: +372 669 2202

Relocating: Tallinn → Zug

Mon-Fri 9:00AM – 6:00PM (CET)

ICC Estonia is a national committee of the world’s most significant business organization ICC WBO.

According to the constitution of ICC Estonia QLA is a member of International Chamber of Commerce – ICC WBO.