360º Due Diligence

Unlocking exponential value & safeguarding capital

360º Due Diligence

Unlocking exponential value & safeguarding capital

Key Partners

Key Partners

Our Approach

We advise exceptional family offices and private equity firms on M&A execution and investment strategies, maximising confidence through a thorough and transparent process.

To enhance valuation – we identify strengths & mitigate risks ahead of fundraising, IPO, or exit. We run comprehensive forensic analysis across technology, digital & brand, financial, operational, and compliance dimensions to ensure deal readiness.

We catch red flags early that save millions for investors.

We operate where capital meets intelligence.

Key steps:

Conduct multi-layered forensic and digital due diligence.

Cross-examine financial, legal, digital, operational data and compliance.

Map ownership structures, capital, and digital footprints.

Translate and turn risk into measurable impact.

Establish security and counter-intelligence protocols to monitor, protect assets and reputation continuously.

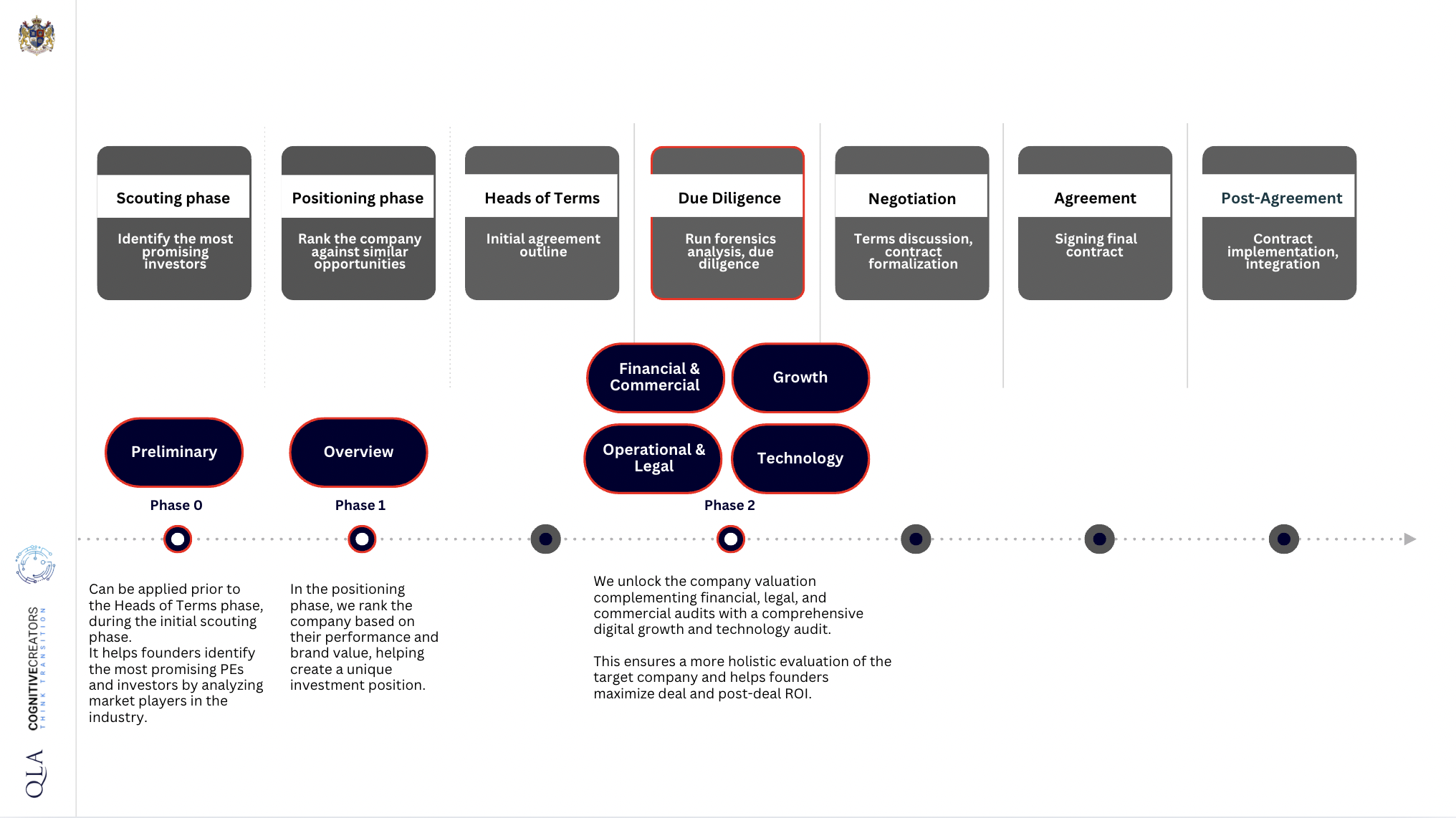

Our Due Diligence approach is delivered in 3 phases pending on where we engage in the investment, M&A and/or fundraising process

Methodology — Data becomes Intelligence

I) Financial & KYC/KYB/AML: P&L, UBO verification, fund-source, liquidity mapping, fraud tracing, forensic accounting, and capital-flow verification.

II) Technological & digital intelligence: Infrastructure audits, cyber posture, DevSecOps maturity, data-leaks, brand power, industry trends, digital landscape, and NIS2-compliant resilience.

III) Operational forensics: Vendor & business-continuity checks, ITSCM performance, and process-risk analytics.

IV) Legal & compliance: Governance, regulatory exposure, documents & policy frameworks.

V) Reputation & behavioural intelligence: Media forensics, digital footprint profiling, and insider-risk detection.

Benefits & Impact

I) Detect hidden liabilities & costs: Inconsistencies, gaps, acquisition metrics, concealed exposure, systemic weaknesses and long-term costs.

II) Integrity assurance: Verify stakeholders, structures, digital footprint, brand perception, behavioural patterns of key people and data before capital deployment.

III) Negotiation leverage: Strengthen deal positions, valuations, pricing, and terms.

IV) Fraud & security prevention/validation: Identify manipulation and/or confirm compliance with the NIS2 Security Framework and operational resilience standards.

I) Ongoing intelligence monitoring: Real-time portfolio and partner monitoring.

II) Asset protection & continuity: Crisis-response frameworks and business-continuity protocols safeguarding enterprise value.

III) Operational layer: G-SOC infrastructure providing live insight into financial, digital, and reputational exposure.

IV) Performance-to-risk translation: Convert operational data into financial impact models for transparent ROI tracking.

V) Strategic counter-intelligence: Protect information flows, IP, and leadership teams from internal or external threats.

Our Added Value

Intelligence and insights strengthen valuation & terms.

Early red-flag detection saves millions, prevents reputational damage, and post deal erosion.

Align & identify future-ready assets, structures, teams, and systems for expansion.

Continuous monitoring translates operational performance into measurable financial returns.

NIS2-aligned, ISO 27001-ready, and fully scalable across multi-jurisdictions.

Case Studies

Our clients include family offices, private equity firms, asset managers, banks, institutional investors, corporates, sports clubs, and government-backed entities.

Introducing DILI: Digital Investment Literacy Index

DILI allows family offices, private equity firms, institutional LPs and M&A advisors to assess their digital-risk literacy against top-performing professionals — all within minutes.

By highlighting digital blind spots that can quietly erode value at scale, DILI empowers investors to make informed decisions with speed and precision.

“Digital blind spots are no longer minor oversights — they carry significant financial consequences,” said Christopher Voolaid, founder of Veritas Civitas: House of Voolaid.

“DILI is designed to give investors a clear, actionable view of their digital-risk literacy, helping them stay ahead in a fast-moving, data-driven world” said Attila Tóth.

Transform intelligence into strategic advantage and let us unlock the full potential of your next investment.

Request an Intro through a trusted channel.

Investing involves risk, including the potential loss of principal. Past performance does not guarantee or indicate future results. Any historical returns, projected returns, or probability forecasts may not reflect actual future performance. Although the data we use from third parties is considered reliable, we cannot guarantee its accuracy or completeness.

Neither Christopher Voolaid, QLA nor any of its affiliates provide tax advice and do not represent in any manner that the outcomes described herein will result in any particular tax consequence. Offers to sell, or solicitations of offers to buy, any security can only be made through official offering documents that contain important information about investment objectives, risks, fees and expenses. Prospective investors should consult with a tax, legal and/or financial adviser before making any investment decision.

Christopher Voolaid and at QLA, we believe success relies on work ethic, knowledge, and consistency. By using the information on this website, you agree to assume full responsibility for your results.

For additional important risks, disclosures, and information, please visit https://qla.ee/disclosures

Talk to Us

IR (Investor Relations): investors@qla.ee

General Info: info@qla.ee

Fax: +372 669 2202

Relocating: Tallinn → Zug

Mon-Fri 9:00AM – 6:00PM (CET)

ICC Estonia is a national committee of the world’s most significant business organization ICC WBO.

According to the constitution of ICC Estonia QLA is a member of International Chamber of Commerce – ICC WBO.